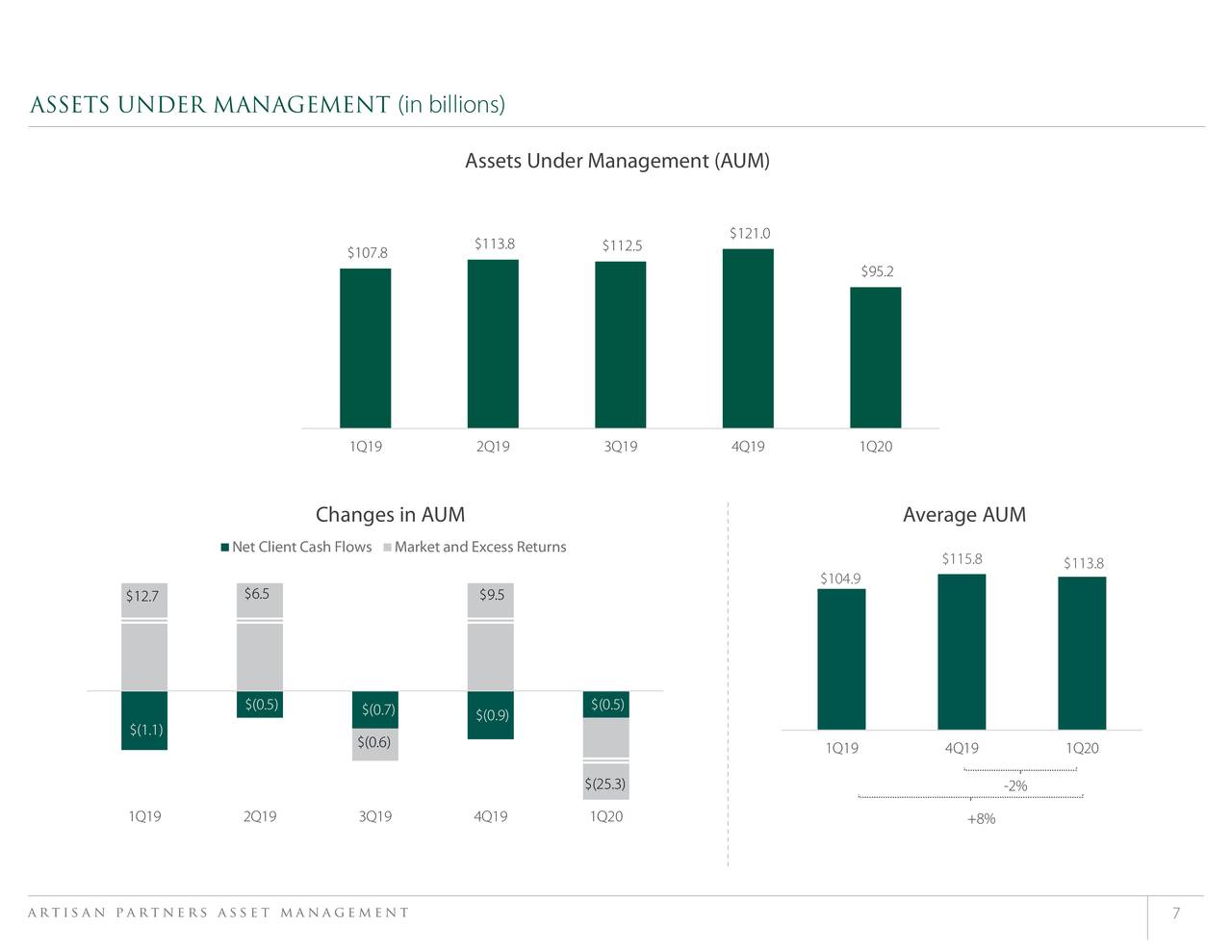

QuoteĬurrently, Artisan Partners carries a Zacks Rank #5 (Strong Sell). price-consensus-eps-surprise-chart | Artisan Partners Asset Management Inc. Price, Consensus and EPS SurpriseĪrtisan Partners Asset Management Inc. The amount will be paid out on Aug 31, 2022, to shareholders of record as of the close of business on Aug 17.Īrtisan Partners Asset Management Inc. The company’s board of directors declared a variable second-quarter dividend of 60 cents per share of Class A common stock. The company’s debt leverage ratio, calculated in accordance with its loan agreements, was 0.4 as of Jun 30, 2022. Balance Sheet Position DeterioratesĬash and cash equivalents were $150.7 million compared with $189.2 million as of Dec 31, 2021. The average AUM totaled $143.9 billion, down 11% from the prior quarter. AUM FallsĪs of Jun 30, 2022, the ending AUM was $130.5 billion, down 18% from the earlier quarter due to global market declines. The operating income was $88.4 million, down 35.9% year over year. The fall was primarily due to lower compensation and benefits, partially offset by higher occupancy, and general and administrative expenses. Total operating expenses amounted to $163 million, down 2.5% year over year. Management fees earned from Separate accounts declined 15.5% to $94.7 million. Management fees earned from the Artisan Funds & Artisan Global Funds fell 17% year over year to $156.6 million. Our estimate for total revenues was $279.9 million. The top line missed the Zacks Consensus Estimate of $264.5 million. Second-quarter revenues were $251.4 million, down 18% from the year-ago quarter. Net income attributable to Artisan Partners (GAAP basis) was $44.3 million, down from $88.2 million in the prior year. Lower assets under management (AUM) on global market declines was another undermining factor. Lower management fees earned from Separate accounts and the Artisan Funds & Artisan Global Funds weighed on the overall top line.

Our estimate for second-quarter adjusted net income per adjusted share was 92 cents. The bottom line declined from $1.28 in the year-ago quarter. Investor Relations Inquiries: 866.632.1770 or Artisan Partners Asset Management Inc.Artisan Partners Asset Management Inc.’s APAM second-quarter 2022 adjusted net income per adjusted share was 79 cents, missing the Zacks Consensus Estimate of 84 cents. Strategies are offered through various investment vehicles to accommodate a broad range of client mandates. Artisan Partners' autonomous investment teams oversee a diverse range of investment strategies across multiple asset classes.

Since 1994, the firm has been committed to attracting experienced, disciplined investment professionals to manage client assets. Separate account and other AUM includes assets we manage in traditional separate accounts, as well as assets we manage in Artisan-branded collective investment trusts, and in our own private funds.Ģ AUM for certain strategies include the following amounts for which Artisan Partners provides investment models to managed account sponsors (reported on a one-month lag): Artisan Sustainable Emerging Markets $53 million.Īrtisan Partners is a global investment management firm that provides a broad range of high value-added investment strategies to sophisticated clients around the world. Total Firm Assets Under Management ("AUM")ġ Separate account and other AUM consists of the assets we manage in or through vehicles other than Artisan Funds or Artisan Global Funds. PRELIMINARY ASSETS UNDER MANAGEMENT BY STRATEGY 2 Artisan Funds and Artisan Global Funds accounted for $67.0 billion of total firm AUM, while separate accounts and other AUM 1 accounted for $71.5 billion. (NYSE: APAM) today reported that its preliminary assets under management ("AUM") as of March 31, 2023 totaled $138.5 billion. MILWAUKEE, Ap(GLOBE NEWSWIRE) - Artisan Partners Asset Management Inc.

0 kommentar(er)

0 kommentar(er)